Keep track of all these year-round tasks and more with the 32 free Jetpack Workflow templates designed to keep your accounting practice on schedule. Financial statements are essential resources business owners rely on to assess the financial health of their operations. Year-end is a busy time for accountants, so here are two of the most important tasks to complete and bring the year to a close. Your clients may receive vendor invoices electronically or by mail, so be thorough to prevent missing a payment deadline. Rather than disappointing your clients, keep your team organized by creating detailed checklists to stay on track.

Close out accounts receivable and payable

Our editorial team independently evaluates products based on thousands of hours of research. Learn more about our full process and see who our partners are here. If you want to wrap up your books by the end of the fiscal year, you need to identify which customers haven’t paid by the due date and send them gentle reminders. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Deposit cash and checks

To keep your receipts in shipshape year-round, make sure you organize from the get-go. As soon as you get a receipt, organize it using your filing or storage system. That way, you don’t have to worry about misplacing the receipt or forgetting debits and credits usage rules examples summary to account for it. You must get an accurate count of the materials and supplies you have on hand if your business has inventory. Otherwise, you could wind up with empty shelves or inventory shrinkage (e.g., expired goods).

Perform the month-end closing process

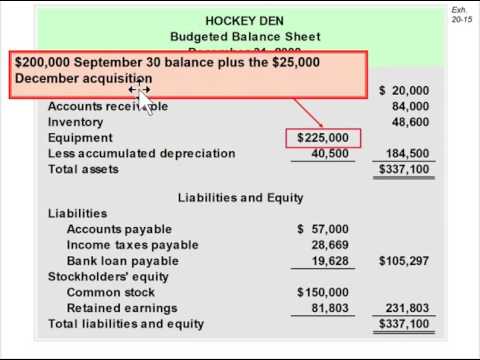

Year-end accounts are the financial statements and reports prepared at the end of the fiscal year. These reports are created by closing the books and provide a summary of the company’s financial position. Year-end accounts include financial statements like balance sheets, income statements, and cash flow statements. Payroll processing includes payroll tax withholding, reporting and depositing income tax, and other tax-related payments. The two most common deposit schedules for taxes are monthly and semi-weekly, and businesses must figure out which schedule they are required to use each year.

The year-end close, although a recurring task, can pose significant challenges for accounting teams, adding to their already demanding workload and causing additional stress. The next section will explain why closing the financial year can become such a difficult task for accounting teams. Month end reconciliation is another term for the month end close process. Some companies use the term because the month end close requires the reconciliation of a range of accounts. The entries in your financial statements must match the entries from bankers, vendors, and other entities.

We made sure that they are ready-made so that you can use and edit them conveniently. After customizing, you can instantly print and download them whenever you want. Small businesses often struggle to collect money on time, resulting in poor cash flow management and bad debt.

Whether you have a seasoned or new business, brick and mortar shop, or online store, you need to handle numerous monthly accounting tasks. All of these accounting checklists are designed to be empowered by automation. If you don’t have any process automation set up in your business yet, no need to worry. With these Process Street are food and meals taxable in michigan checklists, you’ll see how you can integrate Process Street with Zapier and Quickbooks to automate accounting processes, saving you time and money. If you’re managing inventory, set aside time to reorder products that sell quickly and identify others that are moving slowly and may have to be marked down or written off.

It allows you to identify and correct any errors or discrepancies in a timely manner. Create a payroll file sorted by payroll date and a bank statement file sorted by month. Many accounting firms offer bookkeeping services to their clients because it plays a critical role in financial management and decision-making for businesses of all sizes. Accurate bookkeeping is essential for tracking income and expenses, preparing financial statements, and complying with tax regulations. Besides investing in useful accounting software, you can use a monthly bookkeeping checklist to ensure nothing falls through the cracks.

The online checklists summarized here are for use in reporting under International Financial Reporting Standards (IFRS); for specific jurisdictions, please contact us. After all, they have financial obligations that need to be met as well. A handy financial guarantee bookkeepers’ checklist to keep you on the right track at month’s end. If tax work is overwhelming, we offer tax preparation and tax filing services as well. With Bench, you’ll get unlimited year-round tax support to stay on top of your taxes.

- We know that tracking all your receipts, invoices, and other essential documents can be challenging.

- For them, fiscal year-end means managing multiple accounting processes to ensure a smooth financial transition into the next year.

- Some companies use the term because the month end close requires the reconciliation of a range of accounts.

- Once you’ve downloaded your free templates, you can customize them with the specific client tasks you handle and never worry about missing a due date.

Missing just one deadline can create a ripple effect,throwing off your entire system. That’s why you must be aware of upcoming deadlines and plan accordingly to keep your clients’ finances in order. Employees may be entitled to it if they worked more than 40 hours, but it can result in a surprise cost for employers. We provide third-party links as a convenience and for informational purposes only.

You’ll parse through a lot of financial information during these account reconciliation processes. The idea is to look for any material variances between the two months. For instance, if your accounts payable balance increased because you increased the marketing spend or hired more headcount. Aged receivables will help you project future cash flow and if you need to hold a specific cash reserve for delinquent payments. The frequency of employee reimbursements would depend on the frequency of transactions your employees make on your behalf.

Plus, we review a few daily, weekly, monthly, quarterly, and annual accounting tasks successful firm owners keep tabs on to prevent their teams from getting overwhelmed. If the IRS audits your company and finds any underpayment of taxes, it will come to you, not your accountant, for any additional taxes, penalty, and interest. Keep copies of all invoices sent, all cash receipts (cash, check, and credit card deposits), and all cash payments (cash, check, credit card statements, etc.). Primary duties of small business accounting include bookkeeping, preparing and filing tax returns, and drafting financial reports.

When you know your financial tracks are covered, you can focus on the exciting aspects of running your business and bringing new ideas to life. Get into the habit of reviewing your accounting checklists regularly so nothing catches you by surprise later. The best business accounting software can streamline your daily, weekly and annual accounting tasks while helping you manage your finances and fiscal health. When choosing accounting software for your business, consider your budget and specific needs.